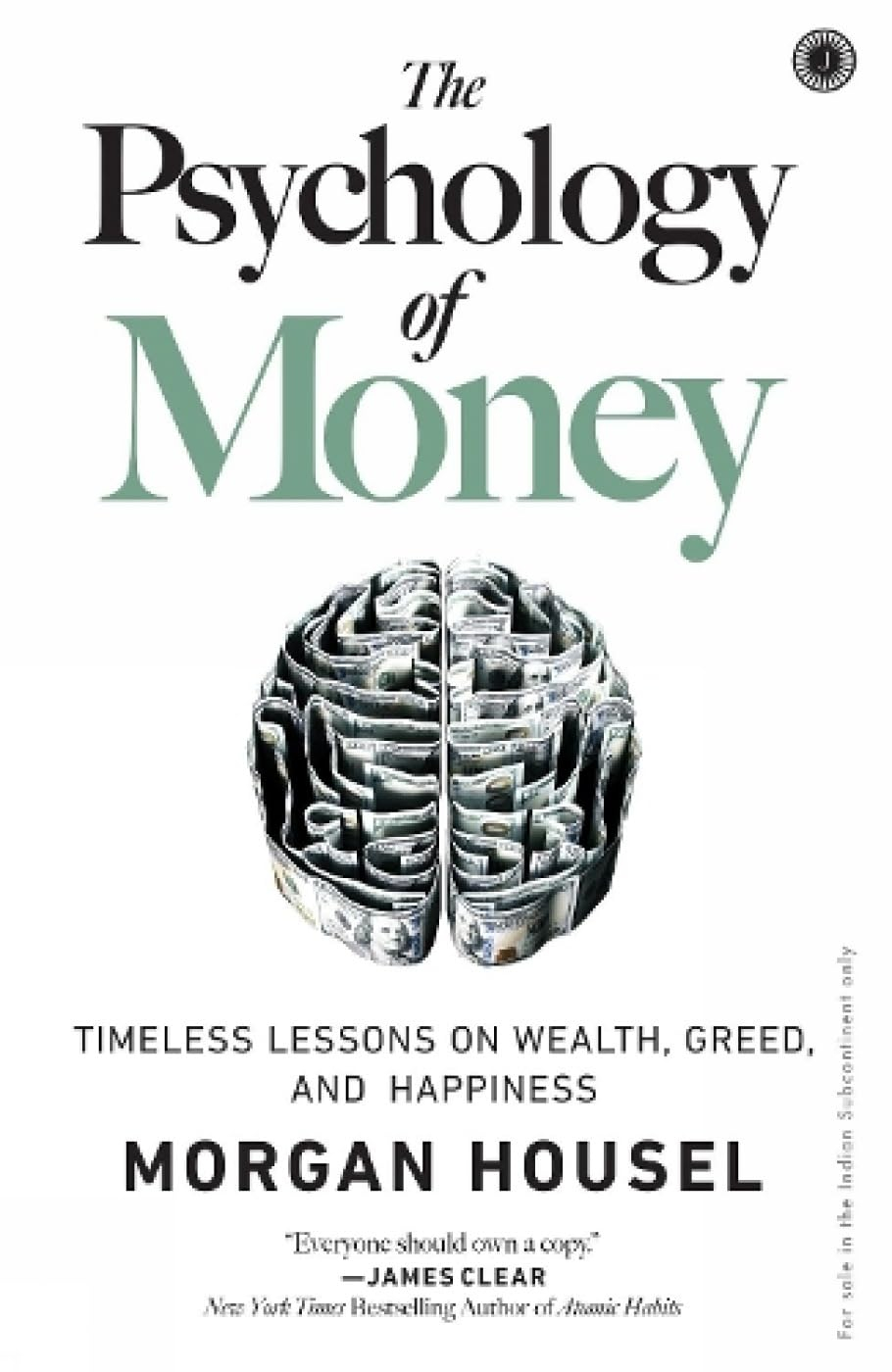

Product description

About the Author

Morgan Housel is a partner at The Collaborative Fund. He is a two-time winner of the Best in Business Award from the Society of American Business Editors and Writers, winner of the New York Times Sidney Award, and a two-time finalist for the Gerald Loeb Award for Distinguished Business and Financial Journalism.

Aritra Sarkar –

4.5 Stars. A curveball by Morgan Housel. With a twist in the middle, this book opened certain viewpoints that changed my financial conceptions.Being from a third world country, My views regarding money were very much different.Still,money is a subject which every person in this world sees as an object of wealth, greed & happiness. Hard work & dedication is one of the main principles to it.What you get is how you think of it.Here are some aspects I searched out to be useful and actionable :> It’s never as good or bad as it seems in finance. Going out of your way to find Humility when things seem right and Forgiveness/Compassion when things go wrong is the way to find peace with money.Respecting the power of money mixed with luck and risk will help you focus on the things that you can control.To be honest -> I am still to find it, I take calculated steps to find peace with my money. I am a bit whimsical when it comes to money. Need to control my urges> Saving money is the gap b/w your ego and your income. Wealth is something created by suppressing the urge to buy now; so as to have more stuff in future.‘No matter how much you earn today, it won’t create wealth unless you discard the thought of how much fun you can have with your money today.’Save, just save. You don’t need to a specific reason.> Manage your money in a way that helps you sleep at night. It is different for different people. Some won’t sleep until they see higher returns on their money; for others it may be investing conservatively. To each their own.> For every investor, the single most powerful thing is to increase the time horizon. It pushes results closer to what people deserve. We can be wrong half the time, and yet make a fortune. It’s OK to be have lots of things wrong, you’re human. Chillax.> Using money to gain control over your time & the ability to do that gives you independence. What you want, when you want, how you want, with who you want, for as long as you want to, pays the highest dividend in money matters.> Being nicer & less flashy with money helps infinitely. No one else’s as much impressed of your possessions as you are. What you most Want is Respect & Admiration, which can ONLY be achieved by Kindness & Humility, not horsepower and chrome.> Defining the cost of success & paying it is obvious coz nothing worthwhile comes free. Uncertainty, doubt & regret are common costs of money world. We must view costs as fees, not fines. Getting one thing for another is a way of life in finance.> Worship room for error is a conservative hedge that gives us endurance. It happens by the gap b/w what could happen in future versus what you think that should happen in future. Incentives are huge motivators in life. So, try to get more out of life.> Avoid extreme ends of financial decisions at all costs helps us get over a feeling of regret as we evolve. All our goals & desires change over time.In our childhood & youth, we crave to consume.In our adulthood, we crave to consume and provide.In our retirement zone, we try to consume again.Consumption and Creation are parts of life.Minimize the wastage of money.> Conservative risks taking help us, it pays off in time. Being reasonable, not overly rational, helps the most in our financial decisions. They are mostly taken, not in boardrooms or on spreadsheets, but at the dining table, with family.> Define the game you are playing & make sure your actions are not being influenced by others who’re playing a different game. Keeping the ball in your court is crucial.Respect the mess coz smart & reasonable people can disagree on your decisions, as they vary in their thought process.

ANUDEEP NAIK –

My thinking about money is more clear now. One of the things that would stay with me is “savings are the difference between your income and ego”

Dr Harshad Ramdas Kadam –

Non prescriptive… Simple and effective perspective on finance and investing! Relationship with “Money” explored beautifully with anecdotes… Hearty Thank you.

Vignesh –

The book gives a 360-degree view of financial management, explaining the factors we need to consider for a financial decision and planning.

Sairam –

Lot of financial wisdom. It should be a read by everyone immediately after they get their first salary or income.

Mukilan –

படிக்க படிக்க ஆர்வம் அதிகமாகி கொண்டே இருக்கிறது…

Gautam –

Nothing out of the world nor any rocket science opined

Amazon Customer –

It’s amazing Book for improving knowledge about money management.

Ayan Majumder –

This book is good . What I like about this book is that it doesn’t give you tips or tricks to do things , but talks about changing the approach of your thinking pattern. This book gives good insight about life lessons not just money . Don’t think this will give you some tips about investment or something , but it will help you make your own pattern . I have read about 10 chapters or so , great read till now.

Siva Naidu –

This is a must read book in personal finance. However the paper quality is not that good.